South Africa

South Africa’s Reserve Bank on Thursday cut its benchmark repo rate by 25 basis points to 6.75 percent from 7 percent.

The rate cut comes after South Africa slipped into technical recession the first quarter.

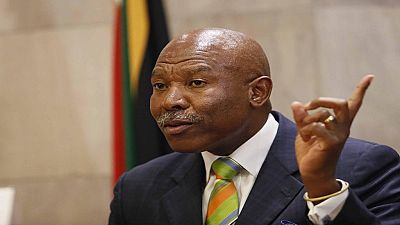

Reserve Bank governor Lesetja Kganyago cited an improving inflation outlook and deteriorating growth.

In the MPC statement the governor said, “the annual average inflation forecast has been revised down by 0.4 percentage points in 2017 and 2018 and by 0.3 percentage points in 2019 to 5.3%, 4.9% and 5.2%.”

The domestic growth outlook remains a concern, following the surprise broad-based GDP growth contraction during the first quarter of this year.With the exception of the primary sector, all sectors recorded negative growth.

While positive growth is expected in the second quarter, the Bank’s annual growth forecasts have been revised down further.

The forecast for 2017 has been adjusted down from 1.0% to 0.5%, and the forecast for 2018 is down from 1.5% to 1.2%. Growth of 1.5% is expected in 2019, compared with 1.7% previously.

The rand weakened as much as 1.2 percent after the decision and pared its losses to trade 0.3 percent lower at 13.9580 per dollar by 7 p.m. in Johannesburg on Thursday.

The Bank’s latest monetary policy meeting took place in a highly politicised environment, after South Africa’s public protector last month recommended that the central bank mandate be changed to place more focus on growth and not just inflation and protecting the value of the rand.

The rate cut is the first since 2012.

Go to video

South Africa's tax row heads to court as implementation date nears

Go to video

South Africa appoints Mcebisi Jonas as special US envoy in bid to ease tensions

Go to video

South Africa: inquest into death of Nobel Peace Prize laureate Chief Albert Luthuli re-opened

Go to video

10.3 Million tons of food wasted in South Africa as chefs push for sustainability

Go to video

South Africans protest gender violence after child rape allegation

Go to video

Rare blue diamond goes on display in Abu Dhabi ahead of May auction