Africa

The coronavirus epidemic continues to disrupt life across the world. The disruption is all but gathering steam in affected even virus-free African countries. The rate of infection is lower on the continent as compared to Europe, Asia and parts of the Americas, where lockdowns are in place.

The impact on gatherings is an area that most African governments have moved to control. A number of business conferences were cancelled on account of the pandemic. A number of governments have also declared State of Emergencies.

South African president Cyril Ramaphosa extensively outlined the economic impact of the pandemic on the economy – mining, tourism – in his first address on Saturday. In Nigeria, the government is looking to revise the current budget.

Our main coronavirus hub is seized with major developments around the epidemic. This piece will focus on the impact on business with emphasis on a raft of incidents that have been undertaken.

Why African skies could recover earlier

African skies could experience increased activity earlier than other continents due to the planned evacuation of people seeking to return home from across the world. This is the view advanced by Tewolde Gebremariam, CEO of Ethiopian Airlines.

In an interview with Bloomberg TV he said of the return to operations: “here in Africa we expect to be slightly faster in recovery,” this is against the backdrop that global flights are forecast to take up to two years to return to 2019 levels.

Air travel was one of the most impacted economic centers as most countries across the world closed their airspaces to passenger flights save in some instances for medical and emergency landings.

The European Union, United States and a number of western governments had also arranged flights to evacuate their citizens across the continent with Ethiopian at the forefront of some of these operations.

Conversely, African governments – most recently Kenya, South Africa, Nigeria and Uganda have all moved to evacuate stranded citizens from different parts of the world. Again, Ethiopian, one of few airlines that continued operations have been key in these flights.

Barely at half-way point of the year, African carriers are estimated to lose some $6 billion in ticket sales. Demand for flights to Asian markets like China and India will particularly pick up faster than to Europe and North America, Tewolde said.

On the subject of bailouts, he stressed that Ethiopian – a continental leader – was not at the stage of seeking any such interventions but that they had other operational areas they seek government support.

“African governments will not be in a position to bail out airlines as much as in Europe and America,” said Tewolde. “Airlines are not flying or generating revenue and governments do not have the resources to bail them out. It is going to be very, very tough for most African airlines.”

Major African stats: May 16 at 7:30 GMT:

- Confirmed cases = 78,280

- Number of deaths = 2,624

- Recoveries = 29,245

- Active cases = 46,411

- Infected countries = 54

May 4: Ethiopian cargo and repatriation ops continue

Ethiopian Airlines, Africa’s biggest and most profitable, was not left out of the effects of the coronavirus pandemic which hit the aviation industry very badly.

Whiles most airlines across the continent are grounded totally, Ethiopian continues flying in two main operation zones – cargo and repatriation flights.

Its cargo operations has seen the airline fly across the world delivering much needed materials in the fight against COVID-19. One of its most recent flights was on May 2 when they transported supplies from Hong Kong to the “rest of the world.”

On May 4, the Airline reported its first international cargo from Burkina Faso to Frankfurt in Germany. The historic consignment included 52 tons of fruits produced by farmers. “The Pan African carrier is glad to serve farmers and is always committed to do so,” the airline added.

The airline has also been at the forefront of repatriating foreign citizens out of Africa. Cameroon to Canada was one of the most recent. The flight was touted as the longest non-stop trip between the two countries.

Ethiopian also partnered with PM Abiy Ahmed in the distribution of medical supplies donated to the continent by Chinese businessman Jack Ma. The airline flew across Africa deploying the materials.

A

— Toronto Pearson (TorontoPearson) May 1, 2020flyethiopianrepatriation flight arrived last night and it could be the world's first non-stop commercial flight from Cameroon to Canada????

World's first or not, we’re proud to play a role in the repatriation of Canadians during this challenging time. Welcome home! pic.twitter.com/hu8Q3D6zkH

Major highlights across March – April 2020

- Africa dominates IMF debt relief list

- Malawi banks agree COVID-19 regulations

- Ghana slash power tariffs, Nigeria says – not yet

- Ethiopian announces big losses

- Ethiopian dismisses layoff reports as fake news

- AfDB approves $2m package for WHO’s Africa response

- Ethiopian suspends ops to over 80 destinations

- East Africa betting down by 99%

- Kenya pay cuts, tax reviews

- Nigeria, Egypt to shut down all airports

- Rwanda fines companies guilty of price gouging

- MTN Nigeria, Cameroon tweak mobile money charges

- African Finance Ministers meet ECA boss via technology

- Nigeria to slash budget

- Ghana, Kenya telcos review mobile money charges

- South Africa apex bank warns against currency scam

- Nigeria reduces petrol price

- Rwanda, Ethiopia move to control prices of essentials

- Nambia economy hit

- Zimbabwe suspends international trade fair

- African airlines to lose big – IATA

April 13: Africa dominates IMF debt relief list

The International Monetary Fund on Monday April 13 announced debt relief for a number of countries across the world citing the impact of COVID-19 on economies and livelihoods.

A statement issued by Kristalina Georgieva, IMF Managing Director said the package applied to the poorest and most vulnerable members to cover their debt obligations. The list of comprised 25 countries out of which 19 were African nations.

They included: Benin, Burkina Faso, Central African Republic, Chad, Comoros, Congo, D.R., The Gambia, Guinea, Guinea-Bissau, Liberia, Madagascar, Malawi, Mali, Mozambique, Niger, Rwanda, São Tomé and Príncipe, Sierra Leone, and Togo.

The non-African bloc are: Afghanistan, Haiti, Nepal, Solomon Islands, Tajikistan and Yemen.

In Georgieva’s words: “Today, I am pleased to say that our Executive Board approved immediate debt service relief to 25 of the IMF’s member countries under the IMF’s revamped Catastrophe Containment and Relief Trust (CCRT) as part of the Fund’s response to help address the impact of the COVID-19 pandemic.

“This provides grants to our poorest and most vulnerable members to cover their IMF debt obligations for an initial phase over the next six months and will help them channel more of their scarce financial resources towards vital emergency medical and other relief efforts.

“The CCRT can currently provide about US$500 million in grant-based debt service relief, including the recent US$185 million pledge by the U.K. and US$100 million provided by Japan as immediately available resources.

“Others, including China and the Netherlands, are also stepping forward with important contributions. I urge other donors to help us replenish the Trust’s resources and boost further our ability to provide additional debt service relief for a full two years to our poorest member countries.”

Meanwhile reports from Ghana indicate that the IMF has approved a $1 bn facility to help the West African country combat the coronavirus pandemic. When President Akufo-Addo weeks back announced a $100m COVID-19 war chest, Finance Minister Ken Ofori-Atta told parliament the amount needed to be raised with support of international lenders.

The International Monetary Fund on Monday said its executive board had approved $1 billion in emergency funding for Ghana and $442 million for Senegal to enable both countries to respond to the rapidly-spreading coronavirus pandemic.

Ghana was at high risk of debt distress, the IMF said in a statement. It said the large disbursement of emergency aid would help the West African countries address urgent fiscal and balance of payments needs, and catalyze support from other development partners.

It said it stood ready to provide further policy advice and further support to both countries as needed.

Senegal, Ghana files from Reuters Africa

April 10: Malawi commercial banks agree new regulations

Commercial banks in the country have suspended interest and principal payments for bank loans for the next three months.

The banks, through the umbrella body, Bankers Association of Malawi (BAM), have also reduced by 40 percent all fees and charges on internet banking mobile payments and other related services.

Reserve Bank of Malawi (RBM) Governor Dalitso Kabambe and BAM Second Vice President Zandile Shaba have announced the new measures in Lilongwe, in line with a recent directives by President Professor Mutharika to cushion Malawians from the negative impacts of the coronavirus pandemic.

The southern African country has nine confirmed cases with one death. The 9th Covid-19 patient is a 44 year-old male and resident of Area 25B in Lilongwe. The man is a Canadian but originally from Burundi who came into the country on March 28 2020.

The Nation Newspaper via Twitter @NationOnlineMw

April 10: Ghana absorbs electricity bills, Nigeria says – not yet

After absorbing three months of water bills in an earlier address to the nation, the Ghana government has announced that electricity bills for the very poor will be fully absorbed by the government whiles a 50% slash will go for other consumers.

In an address on Thursday evening President Akufo-Addo also announced that lockdowns in the capital Accra and the mineral-rich Ashanti region will be extended for one more week.

“We have decided that for the next three months, government will fully absorb electricity bills for the poorest of the poor, i.e. for all lifeline consumers, who consume 0 to 50 kilowatt-hours a month for this period.

“For all other consumers, residential and commercial, Government will absorb, again, 50% of your electricity bill for the next three months. I urge all Ghanaians to exercise discipline in their use of water and electricity,” he stressed.

The president also addressed issues relating to distribution of food items to the poor. He tasked citizens to continue observing all preventive measures and protocols.

“Continue to comply with the measures, maintain good hygiene and respect the social distancing protocols, even when you are going out to receive the food. But, above all, please stay at home. I take no delight in announcing these restrictions, however, let us all remember that they have been put in place for our collective good.

“The fight against Coronavirus has served as a humbling reminder of the things that matter, the things that cannot be bought, and the things that, all too often, go unappreciated, as a result of the stress of daily life,” he added.

Over in Nigeria, the Ministry of Power also clarified in a tweet on Friday that reports of free electricity for two months were not true and that any such decision would be officially communicated.

Please Note: NO DECISION has been taken by the Federal Government to provide Nigerians with FREE ELECTRICITY for 2 months. If and when that becomes a reality, it shall be announced officially.

Be rest assured that FG is exploring ways to ameliorate any hardship on Nigerians.— Office of the Minister of Power (@PowerMinNigeria) April 10, 2020

.embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }

April 6: Ethiopian says layoff reports ‘fake news’

“Ethiopian Airlines strongly refutes the fake news which appeared in some social and traditional media and which wrongly states as it Ethiopian Airlines is laying off employees. Ethiopian Airlines has not laid off any regular employee and has no plans to lay off any regular employee.

“Needless to mention that the airline industry is passing through unprecedented crisis caused by the COVID-19 and Ethiopian Airlines is not an exception.

“Ethiopian Airlines is losing significant part of its regular revenue. However, there is no plan to reduce regular employees,” the full statement read.

A local Amharic newspaper Addis Admas is said to be the originator of the layoff story citing chairman of a workers union, himself affected by the said job cuts. The airline has substantially cut back on its passenger flights and is doing more cargo operations.

As Africa’s most expansive and most profitable, it was one of the most hit airlines and almost the only one that continues to operate amid the coronavirus pandemic.

Statement: AfDB approves $2m package for virus combat

The Board of Directors of the African Development Bank on Tuesday approved $2 million in emergency assistance for the World Health Organization (WHO) to reinforce its capacity to help African countries contain the COVID-19 pandemic and mitigate its impacts.

The grant, which is in response to an international appeal by the WHO, will be used by the world body to equip Regional Member Countries to prevent, rapidly detect, investigate, contain and manage detected cases of COVID-19.

It is one part of several Bank interventions to help member countries address the pandemic which, while slow to arrive in Africa, is spreading quickly and is straining already fragile health systems.

Specifically, the WHO Africa region will use the funds to bolster the capacity of 41 African countries on infection prevention, testing and case management. WHO Africa will also boost surveillance systems, procure and distribute laboratory test kits and reagents, and support coordination mechanisms at national and regional levels.

This grant “ will enable Regional Member Countries to put in place robust containment measures within 48 hours of COVID-19 case confirmation and also support the WHO Africa Region to disseminate information and increase public awareness in communities,” said the Bank’s Human Capital Youth and Skills Development Department.

The grant will contribute toward a $50 million WHO Preparedness and Response Plan, which other partners including the United Nations system, are also supporting.

It is estimated that Africa will require billions of dollars to cushion the impact of the disease as many countries scramble together contingency measures, including commercial lockdowns, in desperate efforts to contain it. Globally, factories have been closed and workers sent home, disrupting supply chains, trade, travel, and driving many economies toward recession.

The Bank Group is expected to unveil a financial assistance package that will enable governments and businesses to undertake flexible responses to lessen the economic and social impact of this pandemic.

Last Thursday, the Bank raised an exceptional $3 billion in a three-year social bond, the proceeds from which will go to help alleviate the economic and social effects of the pandemic. It is the largest dollar-denominated social bond launched in international capital markets to date.

.embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }

Zimbabwe, Nigeria cash transfers to vulnerable

The Zimbabwean government on Monday (March 30) reported that it had budgeted over $600 million to cover one million vulnerable households under a cash transfer programme for the next three months.

The move is part of efforts to mitigate the impact of Covid-19, for which reason government imposed a 21-day total lockdown to contain its spread. The measure announced last Friday started yesterday.

According to Finance and Economic Development Minister Mthuli Ncube, the Social Welfare Department will use its structures to identify the beneficiaries under the facility.

An amount of half a billion dollars has already been provided to fight Covid-19. The ministry said it was ready to attend to more requests. “Vulnerable groups in our society are the most exposed under this Covid-19 crisis,” he said.

“Accordingly, Treasury has set aside resources to cover one million vulnerable households under a cash transfer programme and payment will commence immediately,” he added. Zimbabwe recently okayed the use of the US dollars due to coronavirus related economic squeeze.

The country’s health system is one of the continent’s most fragile. With 7 confirmed coronavirus cases and a death, health workers have threatened to abandon their posts if not provided with the needed protective gear to face the virus.

Over in Nigeria, Africa’s most populous nation, President Buhari in an address last Sunday ordered financial intervention schemes be rolled out for the vulnerable. Lagos state and other states are rolling out state-level interventions.

Sadiya Farouk, minister of humanitarian affairs, disaster management and social development, confirmed on Monday that the ministry has commenced cash transfer to poorest households in the country to cushion effect of the COVID19 pandemic.

Records indicate that as of February 29th, 2020, the Federal Government had identified 10,695,360 individuals in 35 states across the country as the poorest and most vulnerable Nigerians, during this crisis of COVID-19 pandemic. Nigeria’s population is at 200 million.

Two states and the federal capital, Abuja, are currently on lockdown imposed by the federal government. The country has 131 confirmed cases with two deaths. The commercial hub of Lagos as at Monday March 30 accounted for 61% of the total number of cases.

As at February 29th, 2020, the Federal Government has identified 10,695,360 individuals in 35 states across the country as the poorest and most vulnerable Nigerians, during this crisis of #COVID19 pandemic, President

MBuharidirected the FMHDSD to look and take care of them. pic.twitter.com/kvr9Xm5QFv— Bashir Ahmad (@BashirAhmaad) March 30, 2020

Ethiopian’s operational updates

Africa’s most expansive and profitable airline, Ethiopian Airlines, says it has suspended flights to over 80 destinations as at March 29 due to the impact of COVID-19.

The Airline in a statement said all its cargo operations remain intact. “We have continued to operate all our domestic services, but our domestic market has declined by 50%,” they said in a statement.

Ethiopian outlined a series of health and safety measures it had put in place to help combat the virus which has adversely impact air travel across the world.

Among others, disinfection of all work areas, strictly adhering to social distancing among employees and all associates of the company, regular measurement of body temperature and instituting a culture of proper hand washing.

“So far, we have consumed more that half a million each (gloves and masks) and we have more than 300,000 each in our stock so that there is no shortage. We have signed a contract with multiple suppliers for a constnous supply of as many as we require,” the statement added.

The Airline said it had made deliveries of coronavirus donation by Chinese businessman Jack Ma to 51 African countries and some European countries. “We are helping save lives, and this is one of the greatest intrinsic satisfaction in life, for which our brave men and women are proud of,” the statement concluded.

— Ethiopian Airlines (@flyethiopian) March 29, 2020

Betting going extinct

The gambling sector in East Africa is in a “total mess” following the collapse of global sport in the wake of the coronavirus pandemic, a Ugandan betting company has said.

“In terms of sales, we’ve lost about 99% because most of our people are not too much into online betting,” Ivan Kalanzi, a brand ambassador for GAL Sport Betting website, told BBC Sport Africa.

Betting markets have dramatically shrunk in light of the suspension of the world’s leading football leagues, which has left little for people to gamble on.

But in east Africa, the market has been particularly hard-hit because few in the region bet online.

Kenya pay cuts, tax reviews

Kenya’s president has announced pay cuts for himself and his deputy as well as a category of top government officials. All savings are expected to go into helping combat the coronavirus pandemic.

Speaking on Wednesday, President Kenyatta said himself and deputy Ruto will forgo 80% of their salaries whiles Cabinet Secretaries and Chief Administrative Secretaries to take 30% pay cut each and 20% for Permanent Secretaries.

The president also confirmed that the number of cases in the country had increased by four and now stood at 28. Other details he gave during his briefing were:

- One patient has recovered from COVID-19

- National Treasury to offer 100% tax relief to persons earning less than Sh24,000; Income tax down from 30% to 25%.

- Daily curfew from 7pm to 5am effective Friday, March 27, 2020.

- All State and Public Officers with pre-existing medical conditions or aged 58 years and above to take leave or work from home.

March 24: Kenya Airways to fly citizens for free

“As our last flight departs JFK today, we are offering one-way complimentary tickets to Nairobi, to Kenyan citizens in urgent need. Please contact our team on +1(866)5369224 for more information,” this is a tweet from Kenya Airways, KQ, the East African country’s national carrier.

“All passengers will be subjected to entry/screening procedures instituted by the MOH,” KQ added. The airline has suspended all flights in and out of the country whiles government has also announced the closure of all borders in an effort to contain the spread of the coronavirus pandemic.

Kenya currently has 16 confirmed cases with government announcing stricter measures aimed at arresting further spread. Kenyans have hailed the embattled airline for the current gesture.

The Nairobi – New York route was relaunched in October 2018. KQ got permission to operate direct flights to the US in September 2017, after several failures due to non-compliance at its airports.

Instead of 22 hours, the travel time over 13713km between Nairobi and New York had been cut to 15 hours, saving up to seven hours. The historic direct flight is expected to help the company recover from a $267 million debt.

As our last flight departs JFK today, we are offering one-way complimentary tickets to Nairobi, to Kenyan citizens in urgent need. Please contact our team on +1(866)5369224 for more information. *All passengers will be subjected to entry/screening procedures instituted by the MOH pic.twitter.com/LNmUbpVGGY

— Kenya Airways (@KenyaAirways) March 24, 2020

Egypt, Nigeria shut down all airports

Two of Africa’s economic giants, Nigeria and Egypt have shut down all airports to deal with the coronavirus pandemic.

Nigeria had till now shut down all but the Lagos and Abuja airports. The order starts on Sunday March 23 as the country continues to experience rising confirmed cases of the disease.

Egypt will shut down its airports and air travel starting March 31 to contain the outbreak of the coronavirus. The new measures will heavily impact the country’s economy and tourism sectors.

Some 138,000 jobs are immediately at risk and 1 billion us dollars in airline revenues has been lost, according to IATA.

.embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }

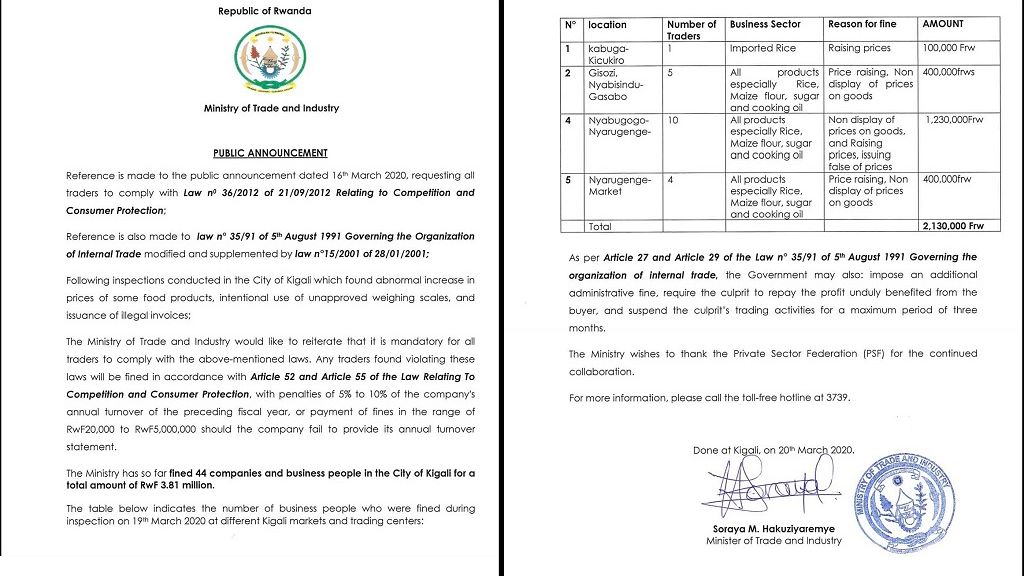

Rwanda fines 44 company for hiking prices

Rwanda’s Ministry of Health has fined a number of companies engaging in price gouging in the wake of the coronavirus pandemic and the attendant race to stock food and get some critical items.

Forty-four companies and business people in Kigali alone have been fined to the tune of 3.81 million Rwandan Francs.

The Ministry along with the Kigali City authorities said the fines related to raising prices of some food products, intentional use of unapproved weighing scales, issuance of illegal invoices, substandard and/or poorly manufactured items.

Asked if the current action related to items that had their prices set and controlled by government, the Ministry clarified: “Only for essential crops. However, in this particular times fighting the spread of Covid-19, we have decided to control prices of basic food items to avoid speculation.”

MTN reviews tariffs in Uganda, Cameroon

Mobile phone giants, MTN, are tweaking their tariffs in the area of mobile money transfers in some African countries with the aim of reducing contact with cash amid the coronavirus pandemic.

The latest developments are in Uganda and Cameroon where the operator is waiving costs on transfers done with their mobile money platform. The MTN Uganda offer included among others:

For 30-days, customers can send up to Ushs 30,000/- (about $8) Mobile Money every day to other MTN MoMo customers free of charge. The offer is meant to reduce the risk of transmission by avoiding the physical exchange of currency notes.

The offer comes alongside a day-time data bundle that will enable Ugandans stay on-line and work from home. Customers will get 1GB of data at just Ushs 2,000 valid between 9am and 5pm.

MTN is also complementing government’s sensitization drive by availing UGX 500 million ($130,000) in cash and free media channel space (radio, tv, social media, SMS, call centre IVR platform) to promote the Ministry of Health’s sensitization messages.

MTN Cameroon said the suspension of payment of fees starts today: “Within the framework of its response plan to the health crisis caused by the Coronavirus / COVID-19, MTN Cameroon announces the suspension, effective Friday, 20 March 2020, of the payment of fees on money transfers between MTN Mobile Money accounts.

“This measure suspending the payment of fees concerns money transfers for amounts up to 20,000 FCFA (twenty thousand francs). The measure will be limited to 3 transactions per day, per account, and will be valid for a period of 30 days. This may be reviewed based on the evolution of the health crisis.

“MTN Cameroon, by suspending the payment of money transfer fees between Mobile Money accounts, seeks to provide its support in the fight against this Coronavirus, by reducing the use of cash as much as possible, and favoring distance payments,” an official statement of March 19 read in part.

MTN Cameroon puts its customers first and suspends payment of money transfer fees by Mobile Money to fight against the spread of #COVID19https://t.co/uQnVPI8xbj#stopcovid19 #BienEnsemble #GoodTogether pic.twitter.com/OdluQmouPN

— MTN CAMEROON (@MTNCameroon) March 19, 2020

Impact of coronavirus on African economies – Analysis

.embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }

African finance ministers in virtual meeting with ECA boss

The United Nations Economic Commission for Africa, ECA, has turned to technology as it seeks to gauge the impact of the coronavirus pandemic on economies across the continent.

ECA boss Vera Songwe in Addis Ababa is host of the virtual meeting expected to last two hours. It is co- chaired by two Finance Ministers; Ghana’s Ken Ofori-Atta and South Africa’s Toto Mboweni.

The ECA headquartered in the Ethiopian capital cancelled a scheduled conference of minister last month at a time that the pandemic was at the stage of an epidemic and was arriving in Africa.

As of today (March 19), there are over 630 confirmed cases with 16 deaths across 34 African countries. The numbers continue to rise as governments move to implement a flurry of restrictions including closing borders and imposing strict public guidelines.

South Africa president Cyril Ramaphosa in an address last Sunday admitted that the country’s economy especially in the area of mining and tourism had been badly hit by COVID-19.

Ghana’s finance minister told parliament recently that a $100 million fund announced by President Nana Akufo-Addo was not readily available and the country may have to turn to international lenders to raise part of the money.

Nigeria to cut budget by 1.5 trillion naira

The record budget of Nigeria, Africa’s largest oil producer estimated at 34.6 billion dollars for the year 2020 will likely be revised downwards, according to the Ministry of Finance.

This is due to the sharp drop in the price of crude oil which is also related to the coronavirus pandemic. The proposed revised figure will be 1.5 trillion naira (about $5 billion) less the original figure of 10.9 trillion naira.

World oil demand is expected to contract this year for the first time in more than a decade, as the coronavirus epidemic is causing a blockage in economic activity, the International Energy Agency disclosed recently.

Another trigger effect of the crisis on the oil market is the tensions between Saudi Arabia and Russia, two OPEC heavyweights that have caused the production pact between the two countries to collapse.

The 2020 budget, adopted in December, was calculated assuming crude oil production of 2.18 million barrels per day at a price of $57 per barrel.

Nigeria is still struggling to emerge from the 2016 recession, which was caused by the collapse of oil prices at the end of 2014, with economic growth currently hovering around 2%.

Ghana, Kenya tweak mobile money charges

As part of measures to reduce handling of cash amid the coronavirus pandemic, Telecom operators in Ghana have agreed with the Bank of Ghana, BoG, to waive charges on a certain amount of transaction.

All transfers of 100 cedis (about $18) or below will attract no charge according to a current directive from the BoG. the measure is supposed to be in place for the next three months.

“The Bank of Ghana has agreed with banks and mobile network operators on measures to facilitate more efficient payments and promote digital forms of payments for the next three months, subject to review, effective March 20, 2020,” a BoG statement noted.

The West African country has a high mobile network coverage with most people preferring money transfers using mobile transactions that banks. All networks have platforms that offer a wide range of services from sending and receiving money to the payment of utility bills etc.

Kenya’s major network operators had also announced a similar measure days back. Kenya’s M-Pesa is one of the most efficient mobile money transaction platforms across Africa.

South Africa central bank warns against currency scammers

The South African Reserve Bank (SARB), the apex bank, on Tuesday issued a public warning that persons posing as officials purportedly collecting contaminated bank notes were fraudsters.

Reports indicate that some people had been going round asking South Africans to surrender their contaminated bank notes and that it was part of the SARB efforts to curb spread of coronavirus.

The BBC reports that persons involved in the scam have been issuing fake receipts for the money collected, saying banks will compensate them.

“The SARB will never ask members of the public to hand over their cash,” the bank said. In a Twitter thread, it said no banknotes or coins had been withdrawn and no instruction issued to hand in money that might be contaminated.

It also urged members of the public to contact the police when approached by “individuals purporting to be SARB employees or representatives”.

Zimbabwe cancels trade fair

Zimbabwe’s President Emmerson Mnangagwa has declared a national disaster over coronavirus even as the country is yet to confirm any case.

Mr Mnangagwa has also postponed independence day celebrations scheduled for 18 April and banned all public gatherings of more than 100 people.

The Zimbabwe International Trade Fair (ZITF) that was to take place in the south-western city of Bulawayo from 21-25 April has also been postponed. The ban will affect church gatherings, weddings and sporting events for 60 days.

The president told a press briefing at his office in the capital, Harare, there would be no travel ban, but discouraged travellers from countries that had confirmed coronavirus cases from visiting Zimbabwe. He also advised Zimbabweans against travel abroad until the pandemic was under control.

Namibia records economic dip

Business dips in Windhoek following Namibia’s first two coronavirus cases on Saturday. Small scale enterprises are lamenting of poor sales as people desert public places as precautionary measures.

“Personally for my job, it went down a bit, because the clients now don’t want to be in public places. I work in a salon and nobody wants to show up because it is crowded most of the time”, a barber said.

For Sylvia Ashipala “Our Namibia is a poor country and there is no medicine or vaccination. What will happen to us with this coronavirus, what can be done? If there is no medicine in the pharmacy?

“For example we work in the government, when we got to the pharmacy to buy pills, we are refused because the pharmacy says the government doesn’t pay, now who will help us? Our country has nothing, no vaccine, no pills.”

Namibia has joined a host of African countries that have taken drastic measures to prevent the spread of the coronavirus. Windhoek has shut down buildings like the National Gallery and libraries in a bid to prevent social gatherings. Notices posted to the premises said the facilities will be reopened on April 14.

01:58

Climate adaption: Unfulfilled pledges mean “lost lives and denied development” – UN chief

Go to video

Vladimir Putin affirms "full support" for Africa

Go to video

Trump and Africa: A new mandate, new uncertainties

11:07

Botswana's new government races to diversify its economy {Business Africa}

Go to video

UK targets Russian mercenaries and military suppliers with new sanctions

01:20

US presidential candidates have no clear Africa policies